Anyone who has been involved with blockchain and cryptocurrency would have heard of Security Token Offering (STO). Just like an Initial Coin Offering (ICO) or an Initial Exchange Offering (IEO) an STO is a model for fundraising blockchain startups. STO is a close modification of an ICO, an attempt to solve the inherent challenges associated with an ICO.

2017 could be termed the most successful year in blockchain fundraising. The ICO model was predominant at this time and recorded great feet. However, despite its success, many blockchain proponents argued that the ICO boom was unhealthy and largely connected with the 2018 crypto winter.

While some claimed that ICO scam-related activities impede confidence in blockchain technology and the whole crypto market. 80 percent of ICO’s are scams, according to the SATIS group, and only 8 percent managed to trade on an exchange. These concerns gave rise to the STO model which was developed to address the security issues associated with ICO.

What Then Is An STO?

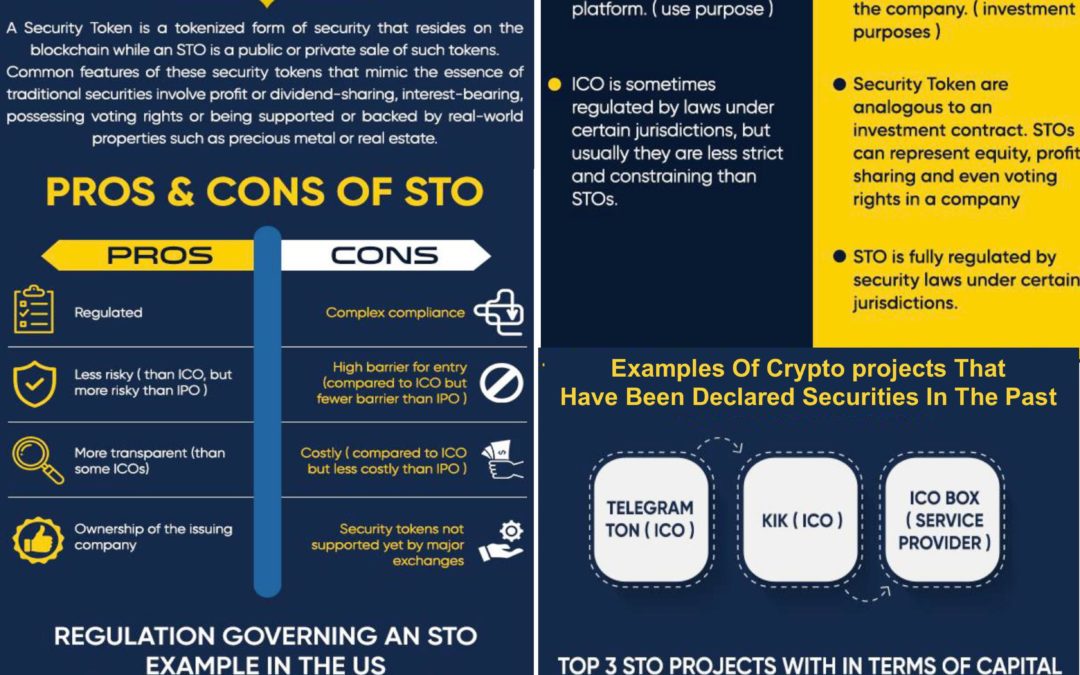

A Security Token is a tokenized form of security or financial asset that resides on the blockchain while an STO is a public or private sale of such tokens.

Common features of these security tokens that mimic the essence of traditional securities involve profit or dividend-sharing, interest-bearing, possessing voting rights or being supported or backed by real-world properties such as precious metal or real estate.

A variety of token standards has grown from the then-familiar ERC-20 standard to conform with STOs which comply with securities laws. This security token standard includes for example the Polymath’s ST-20, ERC-1400 model and Harbour’s R-Token.

Key Difference Between an ICO and STO

The key distinction between an ICO and an STO is that ICO are utilities, and STOs are securities. In recent times, many projects that sold utility tokens did so on the ground of providing its token buyers access to the platform or DApp for future use. The purpose of this token, in this case, is for use, not investment purposes. (at least, in theory…)

On the flipside, STOs selling Security Token are analogous to an investment contract. STOs can represent investment asset, equity, profit sharing and even voting rights in a company.

One other key difference of an STO over an ICO is that the security token is fully regulated by security laws under certain jurisdictions. These security laws are very stringent and binding on projects looking to adopt this model of fundraising. This clearly explains why most blockchain companies prefer issuing utility tokens to by-pass these restrictions.

Regulations Governing an STO

STO regulations are unique to various jurisdiction, the United States, for example, regulations could be considered in three distinct ways:

- Regulation D

- Regulation A+

- Regulation S

Regulation D

Regulation D allows for a specific offer to avoid registration by the Security and Exchange Commission (SEC) if the creators fill out “Form D” after the securities have been sold.

Issuers will operate according to the three laws, Rule 506(b), Rule 506(c) and Rule 504. Rule 506(b) and Regulation 506(c) does not place a fundraising cap but require accredited US investors to participate. On the other side, Rule 504 has no restrictions on the type of investors.

Rule 506C also states that investors are accredited and verified and thus their information is free from false or misleading statements. Regulation D also allows for general solicitation that allows the company to raise awareness through advertising.

Regulation A+

This type requires the company to provide non-accredited investors with a general offer for a gross contribution of $50 million that is SEC-approved. Regulation A+ is suitable for existing startups as it imposes limits on the issuance of financial statements for two years. Unlike Regulation D, Reg A+ has no resale constraints, thus allowing for more liquid markets.

Regulation A+’s security token issuance may take a comparatively longer time to register the security than other options. That is why it is more costly than any other regulation type.

Regulation S

Regulation S applies where there is a security offer to be made in a country other than the US. Thus it is not subject to any requirement for registration under section 5 of the 1993 Act.

However, creators must comply with the security regulations of the country they are executed in.

Most Exchange Commission has adopted Regulation S to shed light on the implementation of the criteria for registration outside the United States and its territories under the Securities Act.

Examples Of Crypto projects That Have Been Declared Securities In The Past

Amidst rising interest in the cryptocurrency, U.S SEC has been giving close monitoring to most blockchain projects that have conducted an ICO in the past. A good example is the Telegram TON ICO, ICOBox, and Kik ICO.

In the case of ICOBox, it was reported that the SEC filed a lawsuit in federal court in the Central District of California against “ICOBox” and its founder Nikolay Evdokimov. The complaints read thus: “the defendants violated federal securities laws by selling tokens that were unregistered securities and acting as an unregistered broker-dealer.”

The Complaint which was filed in August 2017, alleges that ICOBox exposed thousands of investors to risky investments (about $14.6m raised in its ICO) without duly providing the necessary information and protections required by the federal securities laws.

These cases and more are a pointer to the fact that the eyes of the securities and exchange commission are focused on the projects issuing securities in the light of an ICO.

Why Some Investors Prefer An STO

STO provides investors with an extra layer of security: STOs are registered securities with the SEC, therefore, they don’t have to face any future regulatory issues since companies list their tokens as securities from inception. They register for exemptions from U.S SEC which protects them from future Cease and Desist orders, which are very common with ICOs. this helps protect investors.

STO breeds transparency: STOs enable the investor in a company to obtain information about the issuer in a fully transparent way, with full visibility on all the tokens issued, agreed, or discredited. This helps to protect both the investor and the issuer. STOs makes provision for fully mitigated but immutable transparency system by nature.

Ownership of the issuing company: Security tokens give investors legal rights to the ownership of the issuing company. They give the holder substantially greater value, while potentially reducing any associated risk. STOs reflect the underlying interest of investors in the company’s equity, profit sharing, voting rights, and other privileges.

Concerning the rising interest in STO, a handful of STO issuing platform is now in existence. The most popular among them is the Polymath STO platform, others include Securitize, Swarm, Securrency, and Harbor.

According to Polymath, The main purpose of the platform is to help the conventional financial securities integrate with the blockchain tech. The platform also offers a well-detailed guide on processes involved in tokenization.

In recent developments, many accredited exchanges now trade securities token without issues from regulatory laws.

Top 3 STO Projects In Terms Of Capital Raised And ROI For Investors

Polymath

Founded by Trevor Leverkor, Polymath helps to conform financial securities to the know-how of blockchains. The strength of this platform was that it has a robust method of tokenization with a decentralized protocol. The token purchase was only available to eligible participants since the governing specifications of the Safety Token Standard, ERC-400 was followed.

The polymath STO was carried out in 2018 and raised a whopping $58.7M

Blockchain Capital

Blockchain Capital was among the first to issue security tokens to help raise capital to fund their project. Through the sale of the BCAP token in April 2017, Blockchain Capital raised $10 million through a VC fund within a few hours and the rest of the tokens were issued to retail investors. The BCAP token was issued for $1.00 and reached a record high of over $4.8 which printed a 380% return on investment for early investors.

However, trouble started when Blockchain Capital confirmed to all BCAP token holders that they would need to sign and prove that they are approved investors, this prompted massive sell-off and there was a heavy dump by retail investors.

SpiceVC

SpiceVC is a tokenized venture capital company based on blockchain, which released a security token to raise money for its ongoing project. SpiceVC managed to raise $15 million over its 2018 STO.

This security token offering complied with Reg D. Rule 506(c) of the SEC and raised funds from qualified investors in the United States. SpiceVC aims to provide “the first truly liquid and inclusive VC fund to the venture capital industry.”

The token sold between $0.80 to 1.00 and reached a high of $1.37, which is a 37% ROI for investors.

Final Take

Investors have indeed found a safer haven in STO investment due to the transparency, accountability, security and ownership stake in the company. However, the biggest challenges are associated with the general decline in the cryptocurrency market. This has affected investors’ sentiments to a very great extent. But this present market won’t last forever, things are bound to take a good shape in the near future.

Most experts perceives crypto fundraising regulations as a major step forward for the crypto community, as it brings credibility and trust to blockchain and also aid in protecting investors’ interest. Nevertheless, other blockchain proponents consider it a step backward other than a move into the future.

It goes without mentioning that ICOs were created to bypass VCs funding, and thus achieve more participatory and decentralized funding, hence the real interest of fundraising in crypto for some experts.

It is quite possible to mention that VCs were mostly put aside during the golden rush of ICOs, and that STOs are a way for them to catch up.

And you what do you think? Are we going to see a return of ICOs/ IEOs or are STOs definitely the future of cryptocurrency fundraising?

Many thanks, this website is very practical.